AI Stock Market Predictions 2025: How Machine Learning is Disrupting Investing (Palantir, Apple & Beyond)|Dev Tech Insights

Introduction: The Rise of AI in Stock Market Forecasting

The stock market has always been a game of predictions—hedge funds, analysts, and retail investors constantly seek an edge. But in 2025, artificial intelligence (AI) and machine learning (ML) are changing the game entirely.

From Palantir’s(PLTR)AI−drivenfinancialmodels to Apple’s(PLTR)AI−drivenfinancialmodels to Apple’s(AAPL) AI-powered chip advancements, machine learning is now a cornerstone of modern investing. In this guide, we’ll explore:

Need Fast Hosting? I Use Hostinger Business

This site runs on the Business Hosting Plan. It handles high traffic, includes NVMe storage, and makes my pages load instantly.

Get Up to 75% Off Hostinger →⚡ 30-Day Money-Back Guarantee

✅ How AI predicts stock movements (with real-world examples)

✅ Top tech stocks leveraging AI in 2025 (including PLTR,PLTR,AAPL, $AVGO)

✅ Build your own stock predictor in Python (step-by-step tutorial)

Let’s dive in!

Why AI is the Future of Stock Trading

1. Big Data + Machine Learning = Smarter Predictions

AI models analyze millions of data points—historical prices, news sentiment, earnings reports, and even satellite imagery—to forecast trends.

Example:

- Hedge funds like Renaissance Technologies use AI to achieve 30%+ annual returns.

- Retail platforms (e.g., Robinhood, Webull) now integrate AI-driven insights.

2. AI Outperforms Human Analysts

A 2024 MIT study found that AI stock predictions were 15% more accurate than traditional analyst forecasts.

Key AI Techniques in Trading:

- Natural Language Processing (NLP): Scans news and social media for sentiment.

- Deep Learning (LSTMs): Predicts price trends using historical data.

- Reinforcement Learning: Optimizes trading strategies in real time.

Top 3 Tech Stocks Dominating AI in 2025

1. Palantir ($PLTR) – The AI Powerhouse

- Why? Palantir’s AI-powered Foundry platform helps banks and governments predict market shifts.

- Stock Performance: Up 120%+ since 2023 due to AI demand.

2. Apple ($AAPL) – AI Chips & Financial Services

- Why? Apple’s M4 AI chips and growing fintech ecosystem (Apple Pay, Apple Card) rely on ML.

- Prediction: AI-driven services could boost AAPL stock by 20% in 2025.

3. Broadcom ($AVGO) – Semiconductors for AI

- Why? Supplies AI chips to Google, Meta, and Microsoft.

- Trend: AI hardware demand could push AVGOtoAVGOto2,000/share.

(Data sourced from Bloomberg & Nasdaq reports.)

Build Your Own AI Stock Predictor in Python

Step 1: Install Required Libraries

Step 2: Fetch Stock Data

Step 3: Train an LSTM Model

Step 4: Predict Future Prices

Limitations of AI in Stock Predictions

⚠️ Black Swan Events: AI struggles with unpredictable crashes (e.g., COVID-19).

⚠️ Overfitting: Models may work in backtests but fail in real markets.

⚠️ Regulatory Risks: SEC scrutiny on AI-driven trading.

FAQ’S

1. Can AI really predict stock prices accurately?

Yes, but with limitations. AI models (like LSTMs and NLP-driven sentiment analysis) can identify patterns and trends more efficiently than humans, but they struggle with unpredictable events (e.g., geopolitical crises). Most hedge funds using AI see 10-30% better returns than traditional methods.

Useful Links

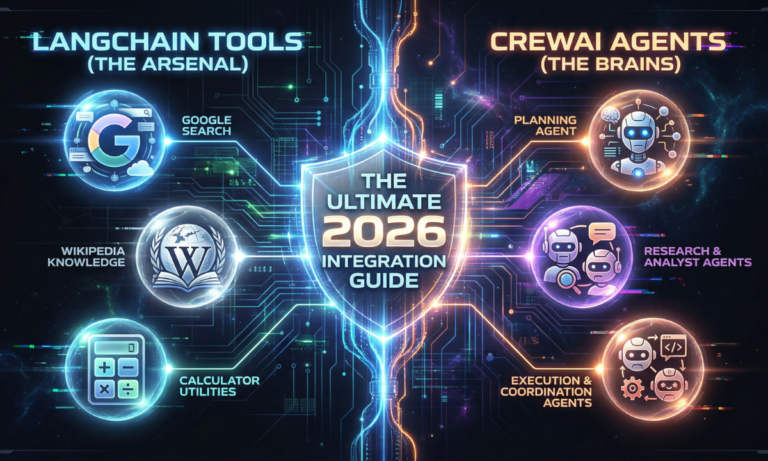

- The Era of Small Language Models (SLMs): Why 2026 Belongs to Edge AI

- Microsoft AutoGen vs. CrewAI: I Ran a “Code Battle” to See Who Wins in 2026

- How to Build AI Agents with LangChain and CrewAI (The Complete 2026 Guide)

- Beyond the Chatbot: Why 2026 is the Year of Agentic AI

- Why Developers Are Moving from ChatGPT to Local LLMs (2025)

- LangChain vs. LlamaIndex (2026): Which AI Framework Should You Choose?

2. Which tech stocks benefit the most from AI in 2025?

- Palantir ($PLTR) – AI-driven data analytics for finance.

- Apple ($AAPL) – AI chips and fintech expansion.

- Broadcom ($AVGO) – Semiconductors powering AI infrastructure.

3. Do I need to be a programmer to use AI for stock predictions?

Not necessarily. Many platforms (e.g., Webull, Robinhood AI Tools) offer built-in AI insights. However, coding your own model (Python + TensorFlow) allows for deeper customization.

4. What’s the biggest risk of using AI for trading?

Overfitting—when a model works in backtests but fails in live markets. Always validate predictions with real-world testing.

5. Can I use AI for day trading?

Yes, but it’s high-risk. AI excels at long-term trend analysis rather than microsecond trades. For day trading, combine AI with technical indicators (e.g., RSI, MACD).

6. How much data do I need to train an AI stock predictor?

At least 5+ years of historical data for reliable results. Use APIs like Yahoo Finance (yfinance) or Alpha Vantage to fetch datasets.

7. Is AI replacing human stock analysts?

Partially. AI handles data crunching, but humans interpret context (e.g., CEO changes, regulatory shifts). The future is AI + human collaboration.

8. What’s the simplest AI model for beginners?

Start with a Linear Regression model (Python’s scikit-learn), then advance to LSTMs for time-series predictions.

9. Are there free AI stock prediction tools?

Yes! Try:

- TensorFlow/PyTorch (build custom models)

- ChatGPT + Wolfram Alpha (for trend analysis)

- TradingView’s AI-powered scripts

Conclusion: Should You Trust AI for Investing?

AI is transforming stock trading, but it’s not foolproof. For best results:

🔹 Combine AI with fundamental analysis

🔹 Diversify across AI-driven stocks (PLTR,PLTR,AAPL, $AVGO)

🔹 Keep learning—try the Python code above!

Want more? Subscribe for our AI & Stock Market Newsletter for weekly insights!

🚀 Let's Build Something Amazing Together

Hi, I'm Abdul Rehman Khan, founder of Dev Tech Insights & Dark Tech Insights. I specialize in turning ideas into fast, scalable, and modern web solutions. From startups to enterprises, I've helped teams launch products that grow.

- ⚡ Frontend Development (HTML, CSS, JavaScript)

- 📱 MVP Development (from idea to launch)

- 📱 Mobile & Web Apps (React, Next.js, Node.js)

- 📊 Streamlit Dashboards & AI Tools

- 🔍 SEO & Web Performance Optimization

- 🛠️ Custom WordPress & Plugin Development

2 Comments

Leave a Reply

You must be logged in to post a comment.

Greetings ffom Idaho! I’m bored to tears at work so I decided to browse your blog on my iphone during lunch break.

I enjoy tthe information you present here and can’t wait to take a look when I get

home. I’m surprised at how quick your blog loaded on my

mobile .. I’m not even using WIFI, just 3G ..

Anyways, excellent site! http://boyarka-Inform.com/

[…] AI Stock Market Predictions 2025: How Machine Learning is Disrupting Investing (Palantir, Apple &… […]